Purchase Order Financing

Kickfurther funds up to 100% of your inventory costs at flexible payment terms so you don’t pay until you sell. fund your entire purchase order(s) on Kickfurther each time you need more inventory so you can put your existing capital to work growing your business without adding debt or giving up equity.

- Often 30% lower cost than alternate lenders & factors

- Quickly fund $5,000,000+ in purchase order inventory

- Create a custom payment schedule (1-10 months)

- Fund PO-backed inventory with no payments until revenue lands

1000+

Deals Funded

$200M+

In Inventory Funded

99.5%

Funding Success

How much funding could your company raise?

Submit this form to see your estimate.

Why choose Kickfurther for

Purchase Order Financing?

Don’t pay until

you sell.

30% lower cost

funding.

Fund up to $5 million

in an hour.

It’s easy, it works, &

it grows with you.

We fund inventory for direct-to-

consumer & major store brands

“Tough Times Call For Creative Funding — Check Out

Kickfurther’s Clever Model”

How does Purchase Order Financing Work?

Connect with consumers across the United States to get your

inventory funded via our marketplace

Create your online account

Create a business account, upload your business information, and launch your deal

Get funded within minutes to hours

Once approved, our community funds most deals within a day, often within minutes to hours, so you’ll never miss another growth opportunity.

Control your payment schedule

We pay your manufacturer to produce inventory. Make the introduction and you’re off and running! Outline your expected sales periods for customized payment terms. At the end of each sales period, submit sales reports and pay consignment profit to backers for each item sold.

Complete and repeat!

Complete your payment schedule and you’re done! Often once the community knows you, you’re likely to get lower rates on your next raise.

PO Financing Options

How do Purchase Orders Work?

Purchase orders generally operate in good faith. They are a form of credit that the buyer and seller partake in outside of traditional banks and financial institutions. Purchase orders are typically for non-retail transactions between two businesses. When a buyer needs a specific product or service from a supplier or a vendor, they will generate a purchase order in their accounting system. A purchase order should contain the following bits of information.

- Billing address of the buyer

- Delivery address of where the goods need to be delivered

- Product or service being purchased

- SKUs or model numbers of the specific products

- Quantity

- Price per unit

- Any wholesale discount information that applies to the purchase

- Payment terms

Once the purchase order has been generated, it’s then sent to the supplier or vendor via mail or digitally. Once the seller has received the PO, it’s customary for them to reply with an order confirmation that details the following bits of information.

- Date that the goods or services should be delivered

- Confirmation of quantities that will ship and that are currently in stock

- If any backorders will need to be placed, and if so, which products and how many of each

- Payment terms

Once the goods or services have been delivered as promised, the buyer then can pay the seller either upon delivery, or if the buyer and seller have a type of business relationship, the seller may offer terms of net 30, 60, or 90 days.

The main idea of the purchase order is to maintain a paper trail between the seller and buyer that confirms a buyer’s intentions. Also, purchase orders help to maintain the accuracy of inventory and finances, ensure faster delivery of goods and services, and are instrumental to each company’s accounting departments.

Types of purchase orders

There are several different types of purchase orders. Some of the most common types of POs include standard, planned, blanket, and contract purchase orders. Here are each of these types of purchase orders in a little more detail.

- Standard PO: A standard purchase order is created when all of the details of the goods and services being purchased are known. A standard purchase order is typically a one-off procurement containing the price, quantity, payment terms, delivery timelines, and location.

- Planned PO: A planned purchase order is more of a long-term agreement between a buyer and seller that commits that the buyer intends to procure the goods or services of the seller only from that specific seller. Planned purchase orders contain all of the same information as a standard purchase order, however, they may also specify how often they would like the order to be duplicated.

- Blanket PO: A blanket purchase order, or blanket purchase agreement, is when the buyer knows the quantities of the goods and services they want to purchase from the seller over a specific period of time, however, they are unsure of when they would like the goods or services to be delivered. Blanket purchase orders are often used by buyers to negotiate discounts and more favorable terms from the seller.

- Contract PO: A contract purchase order is an agreement between buyer and seller that confirms specific terms and conditions, however, a contract PO may not indicate which goods or services are to be purchased and when. Instead, once the contract purchase agreement is in place, the buyer can begin to issue standard purchase orders that contain the agreed-upon terms and conditions.

Who typically creates the purchase order?

Purchase orders are created by the buyer. If it’s a small to medium-sized company, typically the business owner, operations manager, or financial manager may create purchase orders. In larger companies that make hundreds of large purchases every month, they may have a purchasing department with specialized buyer roles. Part of being a buyer is to negotiate discounts and terms for larger purchases with a seller’s internal sales department.

What is Purchase Order Financing?

Let’s dive into the world of purchase order financing and get familiar with the key players involved. Here’s a breakdown of the parties and how we refer to them:

- Seller (That’s You): As the seller, you are the driving force behind the product or service being offered.

- Purchase Order Financing Company: This is the funding partner that will provide the necessary capital to support your business operations. We are the reliable financing partner you can trust.

- Supplier: The supplier, often a manufacturer or supplier, plays a crucial role in producing the high-quality products that you offer to your customers.

- Customer: The customer refers to the retailer or reseller who purchases your products with the intention of selling them to their own customers. They form an essential link in the supply chain.

Purchase order financing enables you (the business) to receive immediate funding to help you cover the costs of producing the inventory covered by a retailer’s purchase order, where you exchange the future, full payment value of the purchase order for an immediate payment at a discount on the full value, often referred to as the “discount.”.

For growing brands, a purchase order represents the potential to enter into wholesale relationships that can increase distribution, awareness, revenue and profit, but a growing company may not have the up-front capital to produce the order’s inventory or it may deplete the company’s cash reserves and cause a significant risk to the ability to cover other operating costs while waiting on the payment terms from the retailer — sometimes as long as two or three months after delivery.

You need funding to produce the inventory so you don’t miss out on the growth opportunity. That’s where purchase order funding comes in so you don’t miss out on a big order that can potentially change your brand’s trajectory.

Sometimes purchase order financing covers the whole order, or just a part of it. In many cases, purchase order financing companies will collect payment for the order directly from the retailer that issued the PO, subtract their fees (the “discount”), and then give the rest of the money to you.

In short, the company that funds your purchase order essentially purchases the purchase order from you for a discounted rate. When it comes to purchase order financing rates, the discount exists for a few reasons:

- This is the cost of their product. Imagine it like this: You’re buying immediate cash on a PO that would otherwise take you months to collect on but you want or need the money now.

- In addition to the fee for their service, the company buying your purchase order from you takes on all the risk of receiving payment from the retailer that will receive your product. Even the biggest, seemingly safest retailers can experience circumstances that prevent making payment to all their creditors (think of companies that Toys ‘R’ Us, now bankrupt, owed money to)

What is the role of purchase orders in inventory?

A purchase order helps to keep a record of specific products and quantities. For example, when a seller receives a purchase order, they know exactly how many of which products are needed to fulfill the order. When the order is being fulfilled, the fulfillment team can accurately pick the correct number of each product and help maintain the accuracy of stock numbers. If the fulfillment team goes to pick an order and they are short on inventory, then it can be noted in the inventory management system to update the stock to account for the missing items, and potentially an investigation will follow.

For the buyer, a purchase order can help when receiving a product. The receiving department of a company typically checks all shipments against a purchase order to make sure that the correct products and quantities were sent by the supplier. If items are missing, they can then notify the seller and the seller can either ship out the missing items or credit the buyer’s account. When the items are received, the buyer then also can enter the quantities and products into their inventory management system to help ensure stock accuracy on their end.

What is a purchase order vs invoice?

A purchase order is a document that a buyer fills out when they wish to express their intent to purchase goods or services from a supplier, vendor, or distributor. The buyer creates a purchase order containing all the necessary information that the seller will need to process the order.

For example, a purchase order may contain information like the name of the company that wishes to purchase the goods or services, the date, a description and quantity of the goods and services desired, the price, a mailing or billing address, a ship to address, payment information, and a purchase order number.

If terms and conditions have already been established between the buyer and seller, then the payment information may simply contain information about how long the buyer has to pay for the goods or services. Typically, this could be 30, 60, or 90 days depending on the nature of the order and the status of the business relationship.

Once the seller reviews the purchase order, they can then confirm the order with the buyer and relay to them any important information. Information like when the buyer can expect to receive their order, how the order will be shipped, if there are any items on the PO that need to be canceled or are back-ordered, and if any special requests can be accommodated or not. Also, the seller will confirm the price and quantities of each item and apply any special discounts that may apply to wholesale orders. Once the purchase order has been approved and confirmed, the seller can devote staff to fulfilling the order, and once the order is ready to ship with all items accounted for, a final invoice is drafted by the seller to send to the buyer.

The buyer will typically receive an invoice inside of their shipment and a digital copy as well that can go to the buyer’s accounts receivable department. Additionally, if the order is shipping freight either domestically or internationally, a copy of the invoice will need to be made available for the transportation company.

The invoice is the final document that is drafted by the seller to collect payment from the buyer. The invoice should contain important information like the company name and contact information of the seller, the company name of the buyer, the date the invoice was generated, the state that goods are shipped or services are rendered, all terms and conditions that apply to the sale, product descriptions including quantities and prices, the total amount due, the currency of payment, and if any taxes apply to the sale.

Both purchase orders and invoices can be seen as legal documents that protect both parties and can help to settle any disputes if any party should happen to be in breach of contract.

What is purchase order factoring?

Similar to PO financing, purchase order factoring is another term for purchase order financing. Often the company purchasing the PO from you is called a “factor.”

How does purchase order financing work?

When a small business is first starting out, one of the biggest issues they may face is cash flow problems. With the launch of a new product or a new website, you may be ill-prepared for strong and sudden demand. You may find that you have sold through most of your inventory and you need to re-up as soon as possible. The only problem is that you do not have enough cash on hand to make a full inventory purchase. This is where purchase order financing can become extremely helpful. Essentially, purchase order financing is a way for businesses to secure the funding they need to buy the inventory needed to complete customer orders. By working with a purchase order financing company, a business can have the PO finance company pay a supplier to manufacture and deliver the goods directly to the customer. The customer then pays the PO company who then takes their initial investment plus any fees and returns the rest of the money from the sale to the business. This makes sure everyone is paid and that the customer does not need to be denied an order. Here is a list that breaks down how purchase order financing works in the simplest steps.

- Receive PO: Customer sends you a purchase order detailing the goods they would like to purchase as well as the quantities. If you are unable to fill the whole order and lack the working capital necessary to complete a new inventory purchase, then purchase order financing is available to you and your business.

- Supplier prepares a quote: Ask your supplier to prepare a quote for how much it would cost to replenish the inventory you need to fill your customer’s order.

- Apply for PO financing: With your customer PO and supplier quote in hand, you can apply for PO financing through a PO finance company. Depending on you and your customer’s creditworthiness, they could agree to finance either 80%, 90%, or 100% of the inventory purchase from the supplier.

- Supplier delivers goods: Most often the supplier will deliver the goods directly to the customer.

- Invoice customer: Invoice your customer for the total amount of the sale.

- Customer submits payment: The customer then is required to pay the invoice directly to the PO financing company rather than to your business.

- Interest is deducted from the total amount: Once the PO financing company has been paid by the customer, they will deduct their fees from the total amount and forward the rest of the money back to your business.

Purchase order financing is a pretty straightforward process and it can be a useful tool to many small businesses who are just starting out and may lack the cash flow to make large inventory purchases to fulfill all customer orders.

Pros & Cons of Purchase Order Financing

Purchase order financing can be the perfect solution to fulfilling new or larger orders than anticipated. In fact, it exists exactly for this reason and because so many companies find themselves in this position. As with any new source of capital, it does have its pros and cons. Let’s take a closer look at them so you can decide if purchase order financing for small businesses is right for yours.

Pros of purchase order financing

- You’re able to take on a client or order you wouldn’t otherwise have been able to

- It’s not a loan, so you don’t have to plan out repayments (your customer pays the finance partner, which then deducts their costs and forwards the remaining balance to you)

- Once you’ve established a relationship with a purchase order financing lender, many businesses report being able to quickly and easily work with them again in the future

- Should your customer not pay, because your purchase order financing lender is the first to be owed money, it will pursue payment, adding strength to your efforts

- Having bad credit won’t necessarily prevent accessing funding since the creditworthiness of your customer is the primary concern

Cons of purchase order financing

- Your lender will take a percentage of the entire purchase order, which eats into your profit from the order

- Fees often range between 1.8% – 6% per month, which can become quite significant if your margins are relatively tight

- Your choice of funding partner can reflect on you. The relationship developed between your customer and your financier could impact the relationship you develop with your customer.

- To qualify, the order total often needs to be substantial ($50,000 or more, typically)

Purchase order financing for small businesses can be the perfect answer to seizing growth opportunities regardless of how much cash you have on hand and can help grow your business fast, but stay educated about how, when and if they’ll work for you. Make sure to review your timelines, when you can expect payments and how financing can impact your margins. In the right circumstances, purchase order funding can help your brand accelerate growth in a way unlike many other financing options available.

Purchase Order Financing Examples

To help you understand, let’s have a look at an example of purchase order financing.

You’re a wholesaler of pet supplies and you get a call from the biggest pet store chain in your state. They’ve been let down by their supplier, and they’re wondering if you can fulfil their needs. You can, and you want to, but the order is the largest you’ve ever had and the cost to produce that amount of inventory is more than you have available. You don’t want to miss out on this opportunity but you know you can’t afford it alone, so you reach out to a purchase order funding provider.

Who Uses Purchase Order Financing?

Purchase order financing is used by a wide range of businesses, such as:

- Any business selling a physical product that can be ordered to be sold by another retailer (wholesale orders)

- Wholesalers

- Distributors

- Resellers

- Importers and exporters

- And generally:

- Any of the above experiencing tight cash flow

- Businesses growing more quickly than cash coming in

- Businesses heavily reliant on seasonal sales that need to order larger inventory runs during their slower cash months

Overall, any business facing cash flow challenges or seeking to capitalize on growth opportunities can benefit from purchase order financing as a means to bridge the gap between receiving orders and receiving payment.

Who can’t or shouldn’t use purchase order financing?

Generally, you PO financing won’t be available to your business if:

- You’re a service provider

- You’re a manufacturer

- You sell raw materials

What is Local Purchase Order Financing?

Local purchase order financing is essentially the same thing as normal purchase order financing. The only difference is that – unsurprisingly – it focuses on local financing. Typically, this means that they will only lend on orders within the same country, though it can be a smaller territory.

Purchase Order Financing Rates

The amount that you can borrow using purchase order financing depends on the size of your purchase order and the creditworthiness of both you and your customer. If you and your customer qualify, then the PO finance company could fund up to 100% of the inventory purchase from the supplier. Typical rates can range anywhere from 1.15% to 6% per month. The PO finance company will deduct those fees once they receive payment from the customer. After the fees have been deducted, the remainder of the money will go back to your business.

What type of businesses is purchase order financing best suited for?

Purchase order financing can work for any type of business that may lack the funds necessary to acquire the inventory necessary to fulfill a customer’s full order. However, some of the most common types of businesses that utilize purchase order financing are the following.

- Wholesalers

- Resellers

- Distributors

- Startups

- Business owners with bad credit

- Importers or exporters of finished goods.

- Outsourced manufacturers.

- Government contractors fulfilling large government orders.

Who issues the purchase order?

The purchase order is created and issued by the buyer who wishes to obtain goods and services from the seller. When a buyer issues a purchase order, they are creating a legally binding document that expresses their intent to procure the goods or services of the seller. The purchase order should detail exactly what the buyer is looking to procure and where the goods or services should be sent or rendered. Once the seller receives the purchase order, they can then look at all of the requested items and either confirm the entire order or inform the buyer of any particular items or quantities that may need to be back ordered or canceled from the purchase order. Ideally, when the seller confirms the order, they will also notify the buyer of an approximate date that they can expect to receive the requested goods or services.

How are purchase orders processed?

Although each company may have its own processes for creating and issuing purchase orders, the main steps for processing a purchase order are similar across most companies and industries. Here are some of the general steps that buyers and sellers need to take when they are processing a purchase order.

- Create a purchase requisition: The person who is looking to purchase the goods or services within the company that is considered the buyer creates a purchase requisition document to obtain permission for the purchase to go ahead.

- Issue the purchase order: Once the purchase requisition is approved by the purchasing department, a quote can be requested from the seller, or if terms and conditions between the two parties have already been established, then the purchase order can be created and issued.

- Seller approves the purchase order: When the purchase order is received by the seller, they can take some time to review the purchase order to confirm that they are able to fulfill the entire order as is. If so, they can approve and confirm the PO. If not, they can amend the purchase order and send it back to the buyer for approval. Amended POs may contain back-ordered or canceled items and corrections of prices and other product details. If an amended purchase order is created, then the buyer has time to review and approve the PO. Once approved, the seller can begin fulfilling the order.

- Buyer confirms receipt of goods or services: When the order has been fulfilled and the buyer receives the goods or services, they can confirm the order against the final PO to make sure everything is accounted for..

- Invoice review: Once the entire order has been successfully received into inventory, the buyer can review the invoice against the finalized purchase order to make sure that everything is accurate. If the invoice is correct, then it can be sent to the buyer’s account receivable department.

- Payment is sent: The accounts receivable department can document the invoice in the accounting system and then issue payment to the seller before the payment due date. If you’re using inventory financing or funding, the backer or lender can pay the supplier to satisfy the purchase order and inventory can be sent to the customer.

What to look out for in purchase order financing

Purchase order financing can be an excellent tool for small businesses that may experience their sales growth outpacing their cash flow. However, it can often be more expensive than other business financing options.

Here are some of the things to look out for when inquiring about purchase order financing.

- Some PO companies charge an upfront fee that you will need to pay out of pocket until the customer pays the invoice for the order.

- Some PO companies will take over communication with the buyer,

- PO companies only give you a percentage of the purchase order amount meaning you will still need a good amount of working capital on hand or secure financing from another source.

- Consequences if the buyer is unable to pay the invoice.

What industries qualify for purchase order financing?

Industries that deal with large volume orders are most likely to qualify for purchase order financing. These industries are, but are not limited to, the manufacturing, retail, import/export, and distribution industries. A cheaper alternative to purchase order financing that can help a wider variety of businesses is inventory funding. To explore one of the most cost-effective solutions for inventory funding, visit Kickfurther.

Purchase Order Financing versus eCommerce financing

Purchase order financing is when a company uses purchase orders from large volume orders to obtain short-term loans to purchase all the supplies they need to fulfill the order. eCommerce financing is similar, however, an eCommerce financing company will typically give a revolving line of credit to a company based on the volume of their online sales. Payments can be automatically made on the amount borrowed from the financing company by giving a certain percentage of the online sales every 15 days.

Are there alternatives to purchase order financing?

Yes, there are a few different alternatives to purchase order financing. The main alternatives include short-term business loans or bridge loans, invoice factoring, and a business credit card.

Where can I get purchase order financing for my small business?

There are plenty of purchase order financing companies out there for any business owner to choose from. Some may be better for different situations. For example, King Trade Capital typically only works with larger businesses whereas SMB Compass has a great reputation for working with small business owners in a variety of industries. Here are the top five most recommended purchase order financing companies for business owners in 2022.

- SMB Compass

- King Trade Capital

- Liquid Capital

- 1st Commercial Credit

- PurchaseOrderFinancing.com

Different purchase order financing companies are known for and best for certain types and sizes of companies. You may want to do some research on different companies before committing. If you have any doubts, you may want to check out some reviews online or ask other business owners their opinions.

How much does purchase order financing cost?

Typical rates that purchase order financing companies charge for their services can range from as low as 1.25% to as high as 6%. Interest is charged on a monthly basis and most purchase order finance companies expect payment within the first 90-days.

What kind of things should I look for when applying for purchase order financing?

Before committing to a purchase order financing company, you should look at how much they charge for their services, what other terms and conditions they may have for their services, and if they have any reviews or any evidence of an established reputation in the business world.

Consider the following factors:

- Experience and Reputation: Choose a purchase order financing provider with a strong track record and positive customer reviews.

- Funding Capacity: Ensure the financing company has the financial capability to support your business needs and fulfill your purchase orders.

- Flexible Financing Options: Look for a provider that offers tailored financing solutions to accommodate your unique requirements.

- Speed and Efficiency: Select a partner that can provide quick approval and funding to meet customer deadlines and seize business opportunities promptly.

- Customer Support: Consider the accessibility and responsiveness of the financing company’s customer support.

- Terms and Fees: Carefully review the terms, discount fees, interest rates, and repayment terms associated with the financing arrangement. Compare options to find the most cost-effective solution.

How purchase order financing can help your business

If you’re a seller, you may be able to obtain financing from the value of your pending purchase orders. For example, if you are in need of short-term funding, financing companies can pay you in advance for an anticipated amount based on how much you are estimated to receive based on the value of the purchase order. This can give some short-term cash flow to companies that can use the money to help fulfill orders that they may not be able to fulfill on their own. This can help them purchase supplies, hire staff, and take other steps to produce the goods or services that the buyer is requesting.

In exchange for the upfront funding, the financing company typically takes a certain percentage of the total sale price that can be paid when the buyer pays the invoice for the order.

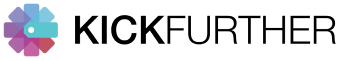

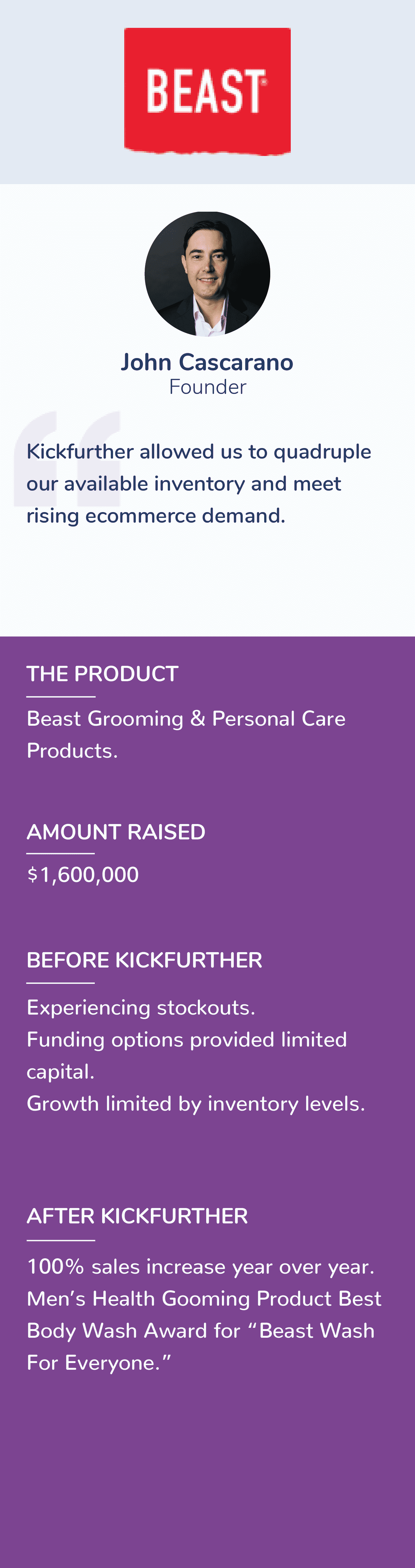

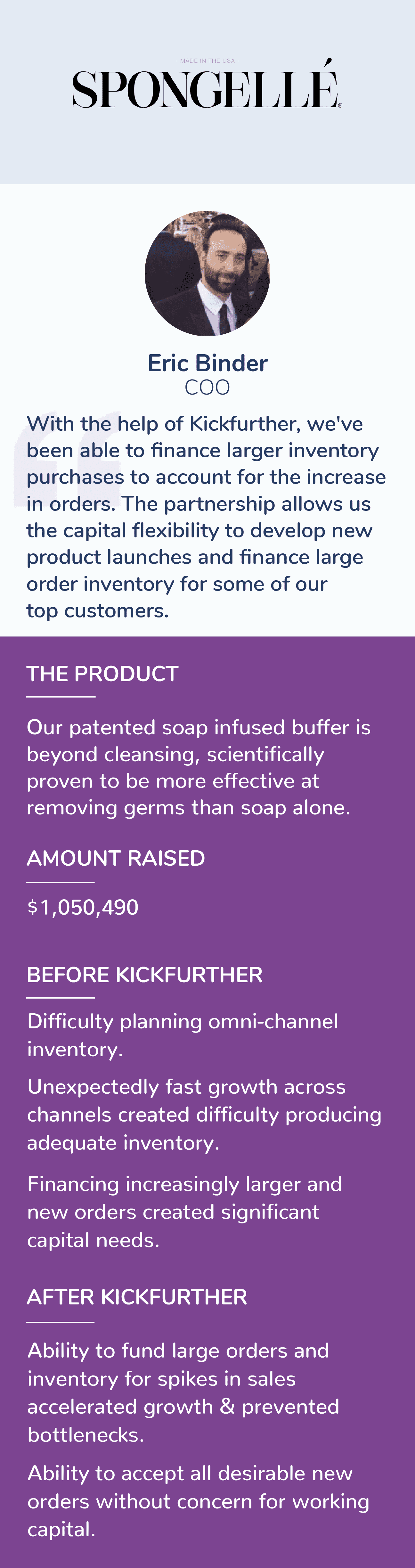

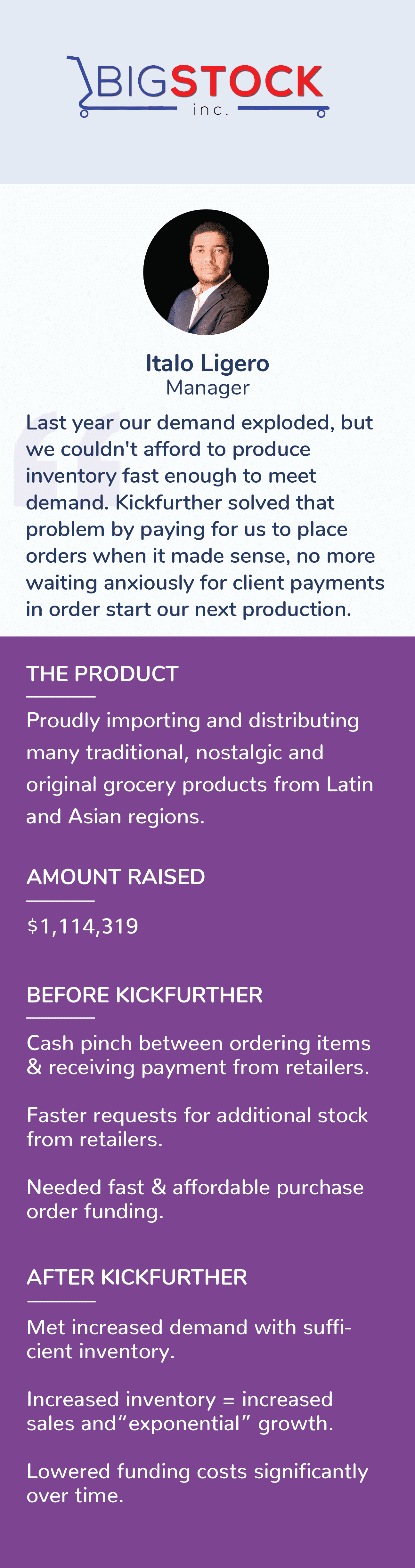

Meet Kickfurther

Kickfurther funds up to 100% of your inventory costs on flexible payment terms that you customize and control. With Kickfurther, you can fund your entire order(s) each time you need more inventory and put your existing capital to work growing your business without adding debt or giving up equity.

Why Kickfurther?

No immediate repayments: You don’t pay back until your new inventory order begins selling. You set your repayment schedule based on what works best for your cash flow.

Non-dilutive: Kickfurther doesn’t take equity in exchange for funding.

Not a debt: Kickfurther is not a loan, so it does not put debt on your books. Debt financing options can sometimes further constrain your working capital and access to capital, or even lower your business’s valuation if you are looking at venture capital or a sale.

Quick access: You need capital when your supplier payments are due. Kickfurther can fund your entire order(s) each time you need more inventory.

Get funded

Get funded with Kickfurther inventory financing

Kickfurther puts you in control of your business while delivering the costliest asset for most CPG brands. And by funding your largest expense (inventory), you can free up existing capital to grow your business wherever you need it – product development, advertising, adding headcount, etc.

Produce & sell more inventory. . . apply for inventory funding on Kickfurther today!

How to Apply and Qualify For Purchase Order Financing

It’s not complicated to apply for purchase order financing, but it can be time-consuming the first time you look for a lender to work with. The good news about purchase order financing is that once you find a solution you like working with, they can become a reliable partner as you grow.

You need to do your due diligence when you search for a purchase order lender, as you should when you look for any type of financing. Search online or ask friends for recommendations and check financing companies’ requirements before you consider applying.

Once you find one you’d like to work with, prepare a few documents they’ll see. These are:

- Your customer’s purchase order

- Your supplier’s estimate or invoice

- Your invoice to your customer

- Your purchase order you submitted to your supplier

- Financial and tax statements, such as your profit and loss statement

You’ll also need any relevant business and legal information.

All lenders have different requirements, but there are a few things you’ll often find as common requirements that you can use as a benchmark:

- Your sales typically need to be over $50,000

- The gross margin needs to be 20% or more

- Your customer also must be creditworthy, because your ability to get PO financing is actually based on them (remember, their ability to pay for the delivered order is chiefly important)

- It must be impossible to cancel the order

- You need to be in good financial standing

Other Industries

Top Blogs

FAQs

How does purchase order financing with Kickfurther work?

Brands can access funding their purchase order from marketplace participants. The marketplace allows brands to access private funding at costs that can improve with each use. Your funding for your purchase order goes directly to your manufacturer for production of goods and you make no payments until you receive and begin selling new inventory.

What are the minimum requirements to qualify for purchase order financing?

- Kickfurther works with brands once they’ve reached at least $150,000 or more in trailing 12 months revenue. You do not need to be in business for 12 months, or have revenue in 12 consecutive months, but we review a snapshot of revenue across a period up to 12 months.

- As we process your application, we review your account statements to calculate your trailing 12 months of revenue. Kickfurther will consider your revenue to be your net sales, which we define as your business’s gross sales minus its returns, fees, allowances, and discounts.

How can I create a Kickfurther co-op for my purchase order?

- Launching a Co-Op for your purchase order involves 3 key steps:

- Create a basic profile including information about your business and product line. Once you’ve done this you can go live with an “upcoming Co-Op” profile that users can choose to follow to hear when your Co-Op launches.

- Determine your Co-Op structure using the Kickfurther calculator to determine costs, earnings, and timeline.

- Verify your Credibility Metrics with the Kickfurther team and finalize your Co-Op profile

How fast will I get funded?

- Once approved and the deal goes live, most deals fund within a day (often within minutes to hours), so you’ll never miss another growth opportunity