On March 20, 2024, five growing CPG brands took the virtual stage at the CPGrow 2024 pitch competition. Hosted by Sean De Clercq, Kickfurther’s CEO and Founder, this event wasn’t just a competition; it was a celebration of creativity, determination, and the entrepreneurial spirit that drives the consumer packaged goods industry forward.

Each brand was given the opportunity to pitch their innovative product and story, followed by a five-minute Q&A session with our panel of judges including Natalie Holloway, BALA, Sumeet Shah, VHS Ventures, and Kelly Wojcik, REI Path Ahead Ventures.

The reward? A staggering $150,000 in no-cost inventory funding along with other grand prizes from our partners that could help transform the trajectory of any scaling CPG brand.

We had over 400 applications and these 6 made it to our live event and got to share their founder story with our amazing judges and audience.

Meet the Finalists

CPGrow featured five scaling brands each with a unique vision and pitch.

The evaluation process was rigorous, but each of these brands had a unique story to share with a strong plan to continue to scale. After receiving over 400 applications, we embarked on an evaluation process to find the brands that provided a compelling story to move them to the semi-finalist round. From there, we reviewed their captivating 60-second pitch, which highlighted their growth plans and why they should be selected as a finalist. We also assessed their financial strength and growth potential. All of these factors painted a clear picture of why these brands stood out and how they would continue to make an impact and succeed in the future.

Watch the recap here.

Caskata

Shawn Laughlin, Founder & Creative Director

Founded on the principles of timeless design and meticulous craftsmanship, Caskata offers a range of beautifully curated pieces that blend classic elegance with modern whimsy. Each item is a testament to the brand’s commitment to quality and distinctive style, featuring intricate, handcrafted patterns inspired by nature and heritage motifs. Whether setting a table for a special occasion or enhancing the everyday, Caskata transforms simple moments into memorable experiences with its exquisite and durable products.

ELAVI

Michelle Razavi, Founder & CEO

Known for their plant-based protein bars and rejuvenating health drinks, Elavi’s products are perfect for fitness enthusiasts and anyone looking to elevate their dietary habits. Made with clean, simple ingredients and a promise of no artificial additives, Elavi is dedicated to purity and performance.

Just Date

Sylvia Charles, M.D., Founder & Chief Innovation Officer

Rooted in the belief that natural ingredients lead to better health, Just Date offers a delicious alternative to refined sugars. Their signature date syrup and sugar products are crafted from high-quality, sustainably sourced dates, providing not only exceptional taste but also nutritional benefits like fiber, antioxidants, and minerals. Ideal for health-conscious consumers who refuse to compromise on flavor, Just Date makes it easy to sweeten anything from your morning coffee to gourmet desserts naturally. Embrace a healthier way to indulge with Just Date’s pure, plant-based sweetness.

Nads Organic Underwear

Daniel Baird, Cofounder & CEO

Founded with the vision of providing environmentally conscious consumers with a guilt-free option for everyday essentials, Nads offers a line of premium, organic underwear that doesn’t just feel good on the skin—it’s good for the planet too. Made from ethically sourced organic cotton, each piece is designed to deliver unparalleled softness, breathability, and durability. Nads Organic Underwear champions the cause of eco-friendly fashion by crafting products that are both biodegradable and stylish, proving that you can make responsible choices without sacrificing quality or comfort.

Seed Ranch Flavor Co

David Delcourt, Chief of Flavor and Co-founder

Seed Ranch Flavor Co. prides itself on creating sophisticated, handcrafted sauces and seasonings that elevate home cooking to gourmet standards. Each product is carefully formulated without artificial additives, relying instead on fresh, organic ingredients and unique spice blends that cater to discerning palates. From smoky hot sauces to aromatic truffle seasonings, Seed Ranch Flavor Co. ensures every dish is not only flavorful but also wholesome.

Our Rising Brand Winner: Quitch

Ilyssa Norda, CEO

Quitch is dedicated to bringing comfort and ease to those suffering from the itchiness and discomfort caused by insect bites. Using a unique blend of natural ingredients, Quitch’s topical treatments are designed to soothe the skin quickly without the use of harsh chemicals. Perfect for adventurers, outdoor enthusiasts, and families alike, Quitch products are easy to apply and essential for any outdoor activity. Say goodbye to the annoyance of bug bites and hello to uninterrupted outdoor enjoyment with Quitch, where nature meets innovation for your comfort.

The Pitch Highlights

From whimsical tableware to groundbreaking food and beverage innovations, each brand brought something unique to the table. Each brand was able to share their story, vision and product with our judges and audience, followed by five minutes of Q&A.

Watch the recap here.

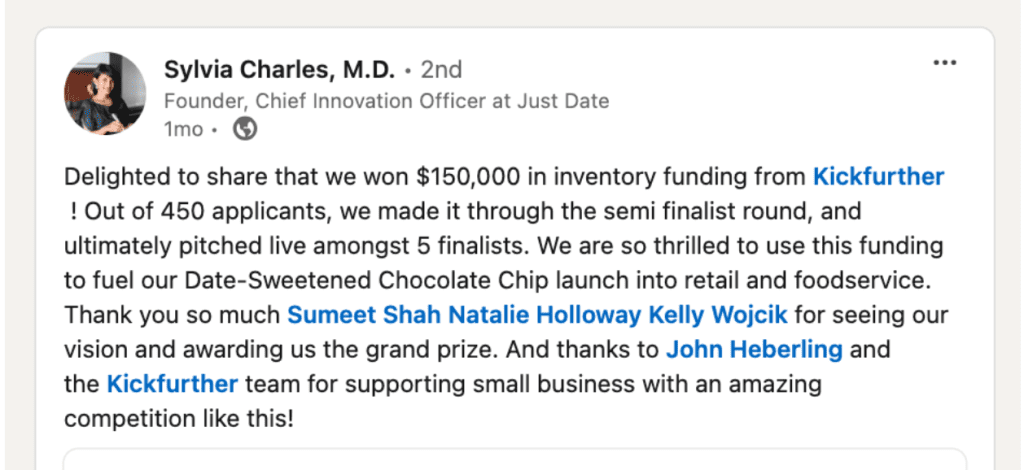

The Winning Pitch: Just Date

Amid tough competition, “Just Date” emerged as the standout brand, captivating the judges and audience alike. Their pitch wasn’t just good—it was a compelling story of how sustainable sourcing and innovative sweeteners can revolutionize the way we think about diet and health.

Learn more about Just Date.

Just Date took home $150,000 in no-cost inventory funding from Kickfurther along with prizes from our amazing partners including:

AVL Growth Partners

60-minute executive consultation with a CPG CFO, a 20% discount on roadmap defining Business Evaluation, and an additional 10% off all professional services moving forward

(Up to $12,000 value)

Forecastr

50% off first-year and waived implementation fee, plus a financial model review and consultation.

($3,000 value)

Hawke Media

Comprehensive marketing audit that entails an exhaustive assessment of your acquisition tactics across Amazon, social platforms, and search engines. Plus a deep dive into email and SEO strategies.

($5,750 value)

RangeMe

Premium Membership

($1,399 value)

ShipBob

Free fulfillment onboarding

($1,500 value)

Kickfurther: Empowering Brands to Grow Forward

We’re incredibly grateful to our community for their support during our first CPGrow event. Kickfurther was built by founders, for founders to empower the growth of CPG brands. By offering funding for up to 100% of your inventory costs on flexible payment terms that you customize and control, we hope to provide CPG brands with the capital they need to grow on their terms.

Thank you to our Partners

We want to extend our gratitude to our incredible partners who played a pivotal role in bringing CPGrow Live to life! Thank you to AVL Growth Partners, eComEngine, Forecastr, Hawke Media, Power to Pitch, RangeMe, and ShipBob.

As we wrap up CPGrow 2024, the excitement doesn’t end here. The conversation about innovation continues, and the journey for our participants and their growing brands is just beginning.

Don’t miss out on your chance to be part of this community. Whether you’re a budding entrepreneur or an established brand looking to break new ground, CPGrow is the platform to showcase your innovation and drive. Stay tuned for next year’s competition—where your brand could be the next big winner!