The Tariff Era Is Here. Your Next 90 Days Are Mission-Critical.

The U.S. recently announced sweeping new tariffs:

- 125% on Chinese imports are effective immediately

- 10% on all other countries for the next 90 days

If you import packaging, components, or finished goods your margins just got tighter.

For consumer brands already battling rising costs, this latest wave of tariffs means the next 90 days will shape your 2025 performance.

At Kickfurther, we teamed up with ShipBob to create a founder-friendly survival guide and to prepare you, but here’s the bottom line:

Raising prices is just one lever. The strongest brands are building multi-layered strategies to protect their margins without sacrificing growth.

What’s the latest on Tariffs?

U.S. tariff policy has undergone repeated dramatic changes over the last few weeks. As of now:

- Most imported goods are subject to a 10% “baseline” reciprocal tariff;

- Higher tariffs for imports from dozens of countries are currently paused through July 8;

- Higher tariffs for most Chinese goods are not paused, and Chinese goods are now subject to new additional 145% tariffs in addition to pre-existing tariffs [multiple layers of tariffs that can equal up to 245% for some products];

- Currently some kinds of goods – notably some kinds of consumer electronics and pharmaceuticals) – are exempt from the new U.S. tariffs, but the administration has indicated it will announce new tariffs for these products in the coming weeks.

- Starting on May 2, Chinese goods valued at less than $800 and shipped through the international postal network will be subject to their own tariff rates – either a 30% tariff or a flat fee per shipment of $25 (from May 2 – May 31) and $50 (from June 1 and after).

The tariff situation is very fluid, with the Trump administration announcing changes to tariff rates and policy on an almost daily basis. The administration may very likely announce new tariffs for consumer electronics and pharmaceuticals, adjust previously announced tariff rates, and seek trade deals with various countries.

What CPG Brands Are Feeling Right Now

In our April 2025 CPG Tariff Impact Survey:

- 51.3% of brands said they’ve already been affected by the new tariffs.

- 63.4% said pricing and margins are feeling the most pressure.

- 41.5% said tariffs have significantly increased their cost of goods sold (COGS).

- 65.9% are planning to raise prices but that leaves a lot of room for competitive advantage for brands that can avoid doing so.

The reality? Brands across home goods, apparel, food & beverage, and beauty/personal care are all being hit. No category is immune.

Margin Protection Playbook for the Next 90 Days

1. Renegotiate With Suppliers Now

Supplier relationships are one of your most powerful margin-protection levers but only if you act early. Waiting until costs spike further could leave you with little negotiating power.

What to do:

- Lock in longer-term contracts now while costs are still semi-predictable. Offer volume commitments in exchange for price stability or improved payment terms.

- Explore alternative materials that avoid tariffs for example:

- Switching from imported aluminum packaging to domestic paperboard.

- Exploring bio-based or recycled materials produced locally.

- Consider tiered pricing structures and negotiate a price floor and ceiling based on tariff scenarios to build in flexibility.

- Be radically transparent with your suppliers. Many of them are facing the same cost pressures and want to retain good customers. A collaborative approach can yield creative solutions like shared freight costs or bundled discounts.

Bonus Tip: Audit all supplier contracts, not just finished goods. Tariffs can sneak in via secondary inputs (packaging, inserts, caps, etc.).

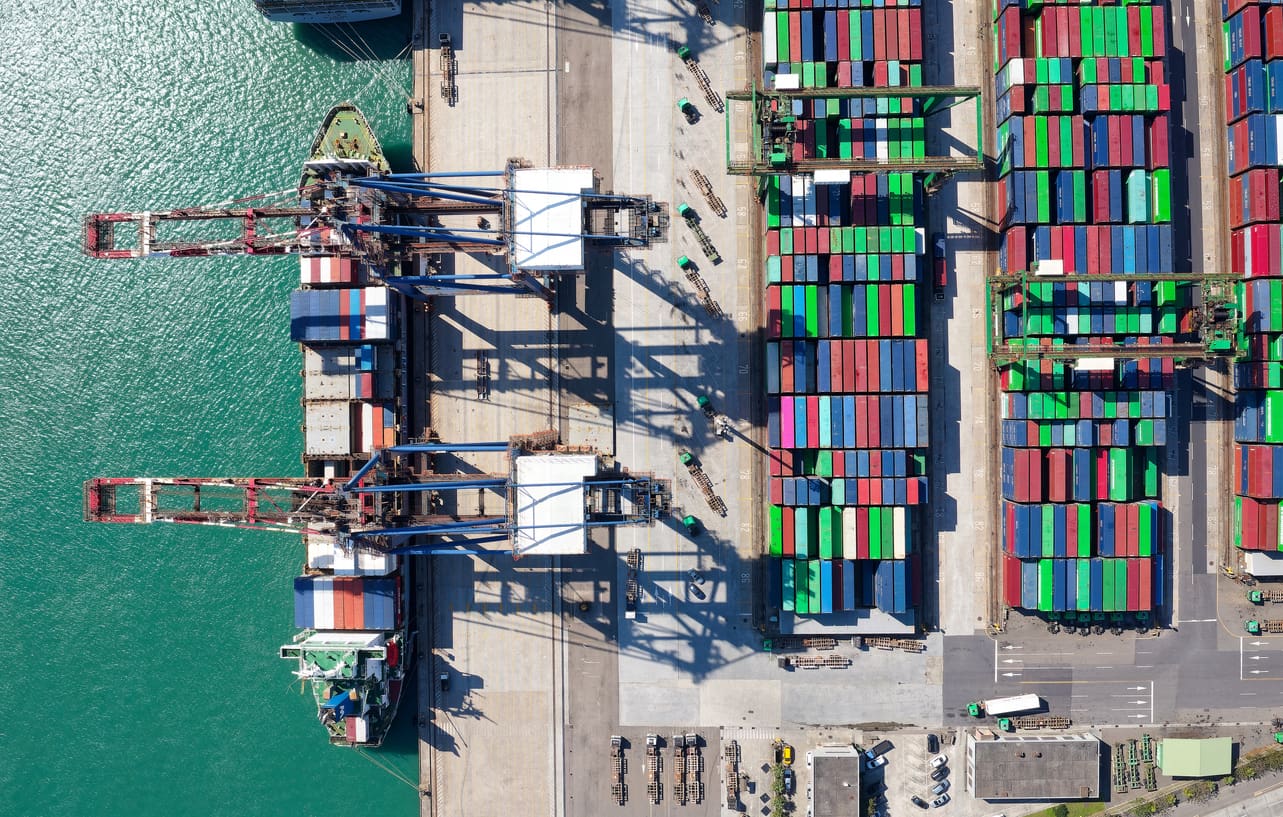

2. Diversify Sourcing Fast

Sourcing diversification is no longer just about “China +1”, it’s about building operational resilience in a volatile world.

Useful Strategies:

- Identify nearshore suppliers in Mexico, Canada, or Latin America, especially given USMCA tariff exemptions on compliant goods.

- Partner with sourcing agents or consultants who already have vetted factory relationships in tariff-free regions. This can shave months off your transition timeline.

- Pilot dual sourcing: Start by allocating 10-20% of production to a secondary supplier. This gives you leverage in negotiations and provides a backup if geopolitical risks escalate.

- Map your supply chain vulnerability: Which SKUs are most tariff-exposed? Prioritize diversification there first.

Smart brands aren’t just looking at price. They’re weighing risk, speed, and supply chain continuity.

3. Reevaluate Domestic Manufacturing

17.1% of brands in Kickfurther’s survey are already exploring domestic production or adjusting timelines to mitigate tariff exposure.

How to Approach This:

- Start with final assembly, kitting, or packaging stateside. This minimizes imported components while leveraging domestic “Made in USA” value perception.

- Analyze freight savings vs. labor cost increases. For heavy or bulky products, domestic production could offset higher wages simply by avoiding overseas shipping and tariffs.

- Consider contract manufacturers with excess capacity. Many U.S.-based facilities are seeking CPG partnerships due to shifting global supply dynamics.

- Leverage the marketing upside: Consumers often associate domestic production with higher quality, sustainability, and ethical labor, all of which can command a price premium.

Reality Check: Domestic manufacturing won’t fit every product, but partial reshoring can offer big wins on margin control and brand positioning.

4. Fund Inventory Strategically to Avoid Overpaying

Timing your inventory purchases around tariff implementation dates is one of the most controllable margin-protection tactics, if you have access to working capital.

Best Practices:

- Place larger, forward-looking orders now, locking in tariff-free inventory for the next 3-6 months of demand.

- Use sales forecasting tools to model demand spikes and avoid overbuying deadstock. Look at year-over-year data alongside emerging market trends.

- Partner with flexible inventory funding platforms like Kickfurther to avoid traditional debt pitfalls. No fixed payments when your cash flow might be volatile.

With Kickfurther, brands can:

- Buy large inventory runs when pricing is most favorable often before tariffs take effect.

- Align repayment with sell-through performance preserving cash flow flexibility.

- Avoid stockouts that could force premium, last-minute airfreight orders (which obliterate margins).

Ways ShipBob Can Help

As a reminder, ShipBob offers:

- Intelligent product distribution and replenishment through our Inventory Placement Program in the US

- DDP shipping for international orders

- Partnerships and introductions we can make to companies across the ecommerce and supply chain ecosystem

Helpful Resources

For the most reliable, up-to-date information, we suggest going straight to the government sources. Below, we share links to the most recently issued guidance and documents:

Final Thought: The Next 90 Days Matter Most

Tariffs are the new reality but how you respond will define your brand’s trajectory.

Most brands will raise prices. Smart brands will build flexibility, resilience, and funding strategies to protect their margins and their customer relationships.

Need help navigating the next 90 days?

Download the by Kickfurther and ShipBob for actionable strategies, funding solutions, and sourcing best practices.

In the meantime, Kickfurther and ShipBob will continue to monitor the ever-changing landscape closely and help you navigate these challenges as they unfold.