Bottom Line Up Front: BFCM success starts with smart cash flow planning, strategic inventory management, and building relationships that extend beyond the holiday season. Some of our industry partners share their tips on how to come out on top this season. Plus, we have the ultimate BFCM prep package to help you succeed.

Black Friday and Cyber Monday can make or break a CPG brand’s year. As we’ve seen with our own clients like The Adventure Challenge, seasonal brands often generate the majority of their revenue during the period spanning from Black Friday through Valentine’s Day, making proper preparation absolutely critical.

Black Friday lands on November 28th this year, but the real work needs to begin months earlier. Inventory must be ordered, cash flow planned, and marketing strategies developed—all while managing the uncertainty of demand forecasting and competitive pressures.

To help CPG brands navigate this complexity, we surveyed our network of trusted industry partners. These experts work with hundreds of consumer brands each year, seeing what works, what fails, and what drives sustainable growth beyond the holiday rush.

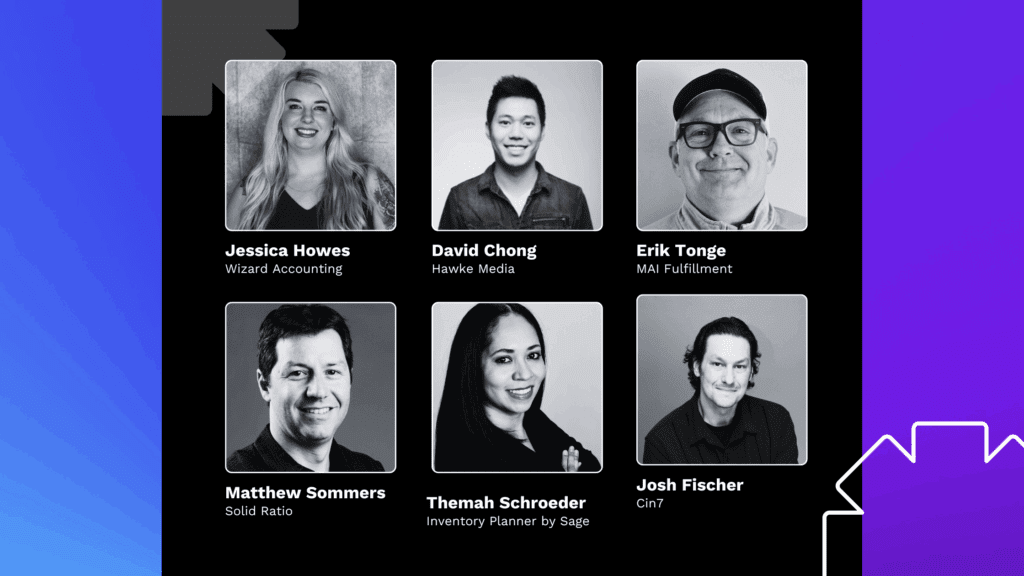

Meet our experts

Financial Planning & Cash Flow

- Matthew Sommers, Partner & CFO at Solid Ratio (Fractional Finance)

- Jessica Howes, Founder/CEO at Wizard Accounting & Consulting

Inventory & Technology

- Josh Fischer, VP Product Management at Cin7 (Lite-ERP Solutions)

- Themah Schroeder, Partner Manager at Inventory Planner by Sage

Marketing & Growth

- David Chon, Director of Growth at Hawke Media

Operations & Fulfillment

- Erik Tonge, Director of Sales & Partnerships at MAI Fulfillment

Financial strategy: Plan cash before you plan discounts

“Plan cash before you plan discounts. Most brands buy heavy in September/October to stock for BFCM, but the cash doesn’t come back until late November or even December. The smartest operators model their inventory buys against both the sales plan and a downside case: What if we miss plan? Can we afford it? Are we comfortable with the risk? Go in with eyes wide open, make the call with data, not hope.” — Matthew Sommers, Solid Ratio

The cash flow gap between inventory investment and revenue realization is the #1 reason BFCM strategies fail. Matthew’s approach of modeling downside scenarios ensures brands can weather unexpected challenges without jeopardizing their business.

Create two financial models: your optimistic sales plan and a conservative “downside” scenario. Ensure you can survive the downside case before committing to inventory purchases.

“A lot of companies offer insane deals at this time in the hopes of getting new customers to fall in love with the product. What actually tends to happen with smaller brands is that they devalue their product and end up losing money during BFCM while also not increasing sales much in the long term. The insane deals are doable for huge brands, but not the smartest play for growing brands. A tip here is to offer a deal that is still attractive, while maintaining the integrity of the product and making some margin even if smaller than typical.” — Jessica Howes, Wizard Accounting & Consulting

Deep discounting can permanently damage brand perception and customer price expectations. Jessica’s advice helps brands balance competitiveness with profitability.

Action Item: Set minimum margin thresholds before planning promotions. Focus on value-adds (bundles, free shipping, exclusive access) rather than steep price cuts.

Inventory optimization: Use AI for data-driven precision

“Let AI guide your inventory ‘sweet spot’ for BFCM. The biggest challenge during Black Friday/Cyber Monday isn’t just demand—it’s uncertainty. The investment you are making in your inventory preparations is (likely) the most significant investment of the year. Many brands overestimate and get stuck with excess stock, while others underestimate and suffer costly stockouts. The key is finding your ‘sweet spot’ where you maximize sales without tying up unnecessary cash in inventory. AI tools like ForesightAI analyze your past sales history, seasonal trends, upcoming promotions, and demand forecasts to predict the optimal inventory range for each SKU by running those numbers through the same industry-leading inventory forecasting algorithms used by Enterprise companies for many decades.” — Josh Fischer, Cin7

Inventory decisions represent the largest financial risk for most CPG brands during BFCM. Josh’s AI-powered approach reduces both stockout risk and excess inventory costs.

Implement demand forecasting tools that analyze historical data, seasonal trends, and promotional impacts to optimize SKU-level inventory planning.

“Don’t Just Stock Up, Strategize. It’s about having the right inventory in the right place at the right time by using your historical sales data and demand forecasting to identify your top-selling SKUs and allocate inventory based on velocity by channel and location.” — Themah Schroeder, Inventory Planner by Sage

Strategic allocation beats bulk buying. Themah’s velocity-based approach ensures your best-selling products are available where and when customers want them most.

The best way to approach this is to analyze sales velocity by SKU, channel, and location. Allocate inventory proportionally to expected performance rather than spreading equally across all products.

Marketing strategy: Timing and targeting are everything

“As customer acquisition costs increase during Q4 due to all the competition, we recommend our clients focus heavily on prospecting now, and then switch to focusing heavily on retargeting during the holiday season. To effectively fill up the top of your funnel, brands should make themselves discoverable across different platforms (Google, TikTok, Reddit, Meta, Pinterest, YouTube, etc.).” — David Chon, Hawke Media

CAC inflation during Q4 can destroy profitability. David’s strategy of front-loading prospecting and shifting to retargeting during peak season maximizes ROI when competition is fiercest.

You can start by increasing prospecting budgets NOW across multiple platforms. Build robust retargeting audiences for November/December activation when conversion rates are higher and CAC is more predictable.

Operational excellence: Going beyond the sale

“Use your holiday orders to seed 2026 sales by dropping a bounce-back insert with a QR that drives to a New-Year-only offer or SMS opt-in. It turns December’s buyers and gift recipients into January customers and gives you a clean channel to remarket all year. Don’t forget to coordinate with your fulfillment partner on any new marketing material you are adding to your customer orders.” — Erik Tonge, MAI Fulfillment

BFCM shouldn’t be viewed as a standalone event but as a customer acquisition driver for the entire following year. Erik’s strategy maximizes the lifetime value of holiday customers.

Design post-purchase inserts that capture contact information and drive immediate next purchases. Coordinate with fulfillment partners well in advance to ensure smooth execution.

The BFCM cash flow challenge: How Kickfurther can help

Every expert we surveyed highlighted the same fundamental challenge: the timing mismatch between inventory purchase and revenue realization. This is where Kickfurther’s consignment model becomes transformational for CPG brands. Get 100% of your BFCM inventory funded now and pay back when you sell it, easing the cash crunch often felt during the gap.

Oh, and we’re sweetening the deal this year with the ultimate BFCM prep package to help you crush this holiday season’s sales.

Sign up for a funding consultation with one of our experts and unlock these amazing perks:

- Acquire inventory funding on consignment (buy now, pay later)

- Get a free copy of Alex Hormozi’s new record-breaking book ‘$100M Money Models’

- Qualify for a 30-minute benchmarking session with an industry expert to see how you stack up against others in your industry

Get started here.

Terms and conditions apply.

BFCM 2025 is approaching fast. The brands that start preparing now—with expert guidance and smart financing—will be the ones celebrating in January.