Forecasting the amount of inventory you need at any given time is always a challenging task. Businesses have to take into account the many variables associated with the timely delivery of stock as well as the unprecedented factors that may affect proper inventory management. While it’s true that inventory management is just one aspect of owning a business, not a lot of people realize the amount of work that goes into considering even the smallest details to ensure that customer demand is met.

Fortunately, there are a lot of techniques that businesses can use in order to avoid inventory issues. Having a deeper understanding of your inventory, through proper inventory forecasting, can help increase your revenue and eliminate stockouts.

What is inventory forecasting?

Inventory forecasting is a method used to predict the amount of inventory needed to satisfy future consumer demand. Businesses that conduct proper inventory forecasting can make informed decisions about future demand which, in turn, helps with financial management and inventory optimization. But how do you actually conduct proper inventory forecasting?

How do you forecast inventory?

Contrary to popular belief, inventory forecasting is more than just educated guesswork. Most inventory forecasting methods involve the use of historical data, past sales trends, and expert opinion from industry experts. However, it is important to keep in mind that inventory forecasts are not foolproof. Unforeseen external factors can always invalidate your predictions no matter how accurate you think they may be. To better understand inventory forecasting, there are certain factors you need to be aware of.

Understanding your inventory turnover ratio

Simply put, a business’s inventory turnover ratio is the rate at which a business sells and replaces its inventory during a certain period. If you’re wondering how you can calculate your own inventory turnover ratio, use the formula below:

Cost of Goods Sold ÷ Average Inventory = Inventory Turnover Ratio

What’s the importance of inventory turnover for a business? Great question! If you want to accurately predict your future inventory needs, it is absolutely necessary to look at how fast your inventory sells. Your inventory turnover ratio should also give you an idea about how efficient your operations are compared to industry standards. In general, a high turnover ratio means your sales are strong while a low turnover ratio indicates poor sales and excess inventory.

Improving your lead time

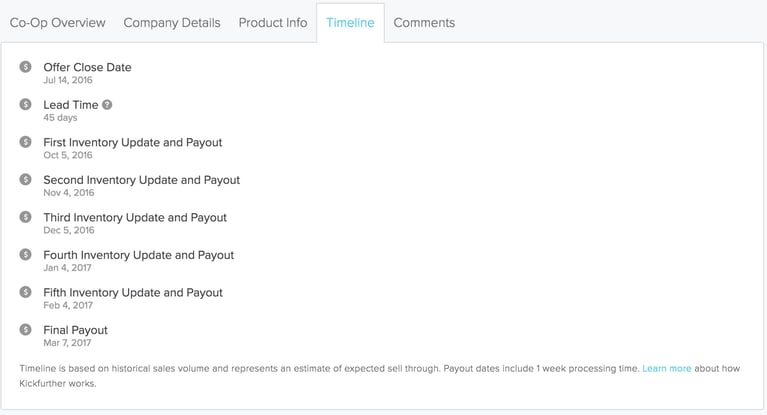

When it comes to inventory management, lead time represents the time it takes for a company to fulfill an order and replenish inventory after a customer receives an order. Factors such as shipping delays, stockouts, and human error may all play a role in longer lead times. Improving your lead time lets you get ahead of the competition by increasing the efficiency of your output, translating into faster order fulfillment.

Setting your reorder point

The reorder point (ROP) is the threshold that businesses set to trigger stock replenishment. According to QuickBooks, a specific product’s reorder point can be calculated by multiplying a product’s average daily sales to its delivery lead time and adding that to your safety stock.

(Average Daily Sales x Delivery Lead Time) + Safety Stock = Reorder Point

Setting an accurate reorder point saves businesses money from unnecessary inventory holding costs as well as prevents stockouts. It’s also important to remember that different products get sold at different rates. This means that you may have to set different reordering points depending on a product’s average daily sales.

Calculating your safety stock

As the name implies, safety stock refers to the extra inventory held by a business to reduce the risk of stockouts. Having the right amount of safety stock allows businesses to keep extra products on hand in case there is an unexpected increase in demand or a supplier fails to deliver items on time. Here’s how you can calculate your safety stock:

(Maximum daily usage x Maximum lead time) – (Average daily usage x Average time in days) = Safety Stock

Analyzing industry trends

No matter how established your business is, one trend change may affect the overall demand for your product. While qualitative in nature, looking at industry trends is one of the most important facets of inventory forecasting. Spotting and analyzing relevant trends help businesses predict where an industry is headed and allows them to always stay ahead of the competition.

Considering the seasonality of your products

In business, seasonality refers to expected changes that affect the availability of products as well as fluctuations in demand and quantity. Seasonality plays an important role in understanding why businesses have high or low seasons and gives them an idea about what type of forecasting methodology to use.

How to do inventory forecasting? What are the different techniques?

As mentioned in the previous section, there are different factors to consider when forecasting inventory. The same goes when choosing which inventory forecasting technique to utilize. In this article, we will talk about two types of forecasting methods: qualitative and quantitative inventory forecasting.

What is qualitative forecasting?

Qualitative inventory forecasting involves predicting consumer demand based on trends, seasonality, and the current status of the industry and the overall economic climate. This type of forecasting method is often characterized as subjective and non-mathematical. Qualitative forecasting is most useful in situations where data is unavailable or inadequate. Its main advantage is its ability to see external factors that may influence consumer behavior. Usually, qualitative forecasts are given by experienced sales professionals, production planners, marketing managers, and industry experts. Some of the most common types of qualitative forecasting include gathering executive opinion, conducting market research, and using the Delphi technique.

Side note: The Delphi technique is a forecasting method that collects the opinions of industry experts through a series of questions. When it comes to inventory management, this type of qualitative forecasting method is often used to predict future demand for a certain product.

What is quantitative forecasting?

Quantitative forecasting, as opposed to qualitative forecasting, involves the use of concrete data when predicting future revenue. Through the application of statistics on historical data, businesses can accurately calculate future demand as well as determine patterns that may influence a product’s future sales performance. What sets quantitative forecasting apart is its objectivity. This means that forecasts are based on hard numerical information and are not susceptible to prejudice or partiality.

What is the importance of inventory forecasting?

Inventory forecasting, if done properly, helps businesses secure enough stock to satisfy customer demand. It also gives businesses an idea about how much future capital they would need to be able to purchase additional inventory and meet customer demand. Other benefits of inventory forecasting include:

- Reduce the instances of overstocking and stockouts

- Increase customer satisfaction

- Better overall inventory management

- More accurate budgeting and labor scheduling

One underrated benefit of inventory forecasting is more accurate budget planning. Businesses, especially small to medium ones, do not have the same financial leeway as their larger counterparts. This means that small to medium-sized businesses are more prone to overstocking and stockouts due to a plethora of negative factors such as inventory mismanagement, delivery and logistics issues, and working capital shortage.

If you don’t want to miss out on future sales due to poor cash flow, you should check out Kickfurther.

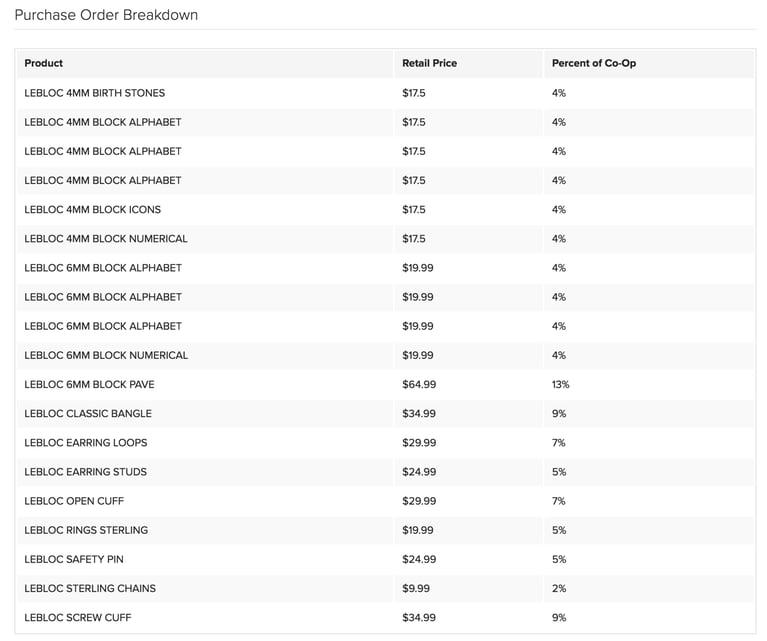

Kickfurther is the world’s first online inventory financing platform that enables companies to access funds they usually cannot acquire through traditional sources. We connect brands to a community of eager buyers who help fund the inventory on consignment and give brands the flexibility to pay that back as they receive cash from their sales. This alleviates the cash-flow pinch that lenders can cause without customized repayment schedules allowing your brand to scale quickly without impeding your ability to maintain inventory.

.png?width=800&height=580&name=invoice-vs-purchase-order-invoiceberry%20(1).png)