Growing a product business has never been about demand alone. It’s also about timing. Founders feel that gap every time a supplier needs payment upfront, while revenue is still weeks or months away. We built Kickfurther to bridge that gap with consignment-based inventory funding that aligns payment to actual sales, not fixed schedules.

Today, we’re making access to that model available to even more emerging brands.

What’s New

Kickfurther is expanding its qualification criteria to support brands with $200,000–$400,000 in trailing twelve-month revenue, as long as they hold purchase orders from national retailers such as Target, Walmart, Costco, Amazon, and others.

This means more early-stage founders can say yes to every opportunity–not just the ones they can afford–with access to inventory funding that doesn’t restrict cash flow.

Why We’re Making This Change

Founders at this stage have proven something important: customers want their product, and now major retailers do too.

What they often don’t have is the working capital to fulfill those large POs without draining cash or taking on personal risk. Traditional financing wasn’t built for this moment:

- approval is slow

- payments start immediately

- and capital is credit-based rather than sales-based

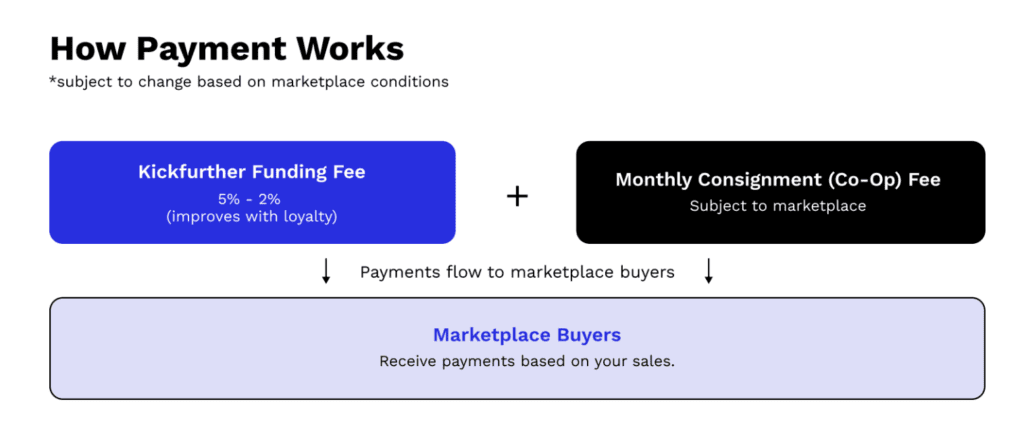

Kickfurther’s model flips that dynamic:

- We pay your supplier upfront (or fund recent orders) so you can stock up with confidence

- You pay us back only as the inventory sells, without adding debt to your balance sheet

- Your working capital stays free for marketing, hiring, or simply stabilizing operations as you grow

Emerging brands with real traction deserve a capital structure that moves at their speed. This update gives them exactly that.

Who Now Qualifies Under the Expanded Criteria

A brand is now eligible if it:

- Is a US-based company

- Sells physical products

- Has at least $200,000 in trailing twelve-month revenue

- Holds active purchase orders with national retailers (Walmart, Amazon, Target, Costco, etc.)

This update ensures that brands with meaningful retail opportunities are no longer held back by revenue limits.

What This Means for Founders

If you’re building an emerging CPG brand, this expansion means:

You can finally say yes to major purchase orders

Retailers move fast. Cash flow shouldn’t slow you down. Capture every order and unlock volume discounts you may not have been able to reach before.

You don’t have to choose between growth and liquidity

Inventory shouldn’t force you to pull back on marketing, team support, or product development.

You can grow without debt or dilution

Consignment funding keeps your balance sheet clean and your ownership intact.

You get more than capital. You get a partner.

Founders describe Kickfurther as feeling like a “coworking experience,” not a transactional lender. We’re here to help CPG founders grow and succeed—and we’re in it for the long haul.

Why This Matters for the CPG Community

The early-growth stage is where many great brands stall. And it’s not because demand isn’t there; it’s because capital options don’t align with how product businesses actually operate. Long lead times, upfront supplier payments, seasonal shifts, and retailer terms all create friction that traditional financing wasn’t designed for.

Kickfurther’s expansion brings more founders into a model aligned with how their businesses truly work.

Looking Ahead

This is one step in a broader effort to support the full spectrum of CPG builders, from emerging brands proving demand to established operators scaling multi-SKU portfolios. As brands grow, our funding limits and pricing improve with them, creating a long-term partnership that compounds over time.

If your brand now falls within the updated criteria and you’re preparing for your next production run or fulfilling a new retail partnership, we’d love to support you.

Connect with our team to see if Kickfurther’s consignment-based inventory funding is the right fit for your next stage of growth.