Finding the right funding for your brand shouldn’t feel like guesswork. And with so many options available these days, it sometimes can.

Whether you’re a food and beverage company looking to scale production, an apparel brand preparing for seasonal inventory, or a health and wellness business expanding into retail, understanding which funding option aligns with your business model can save you time, money, and headaches.

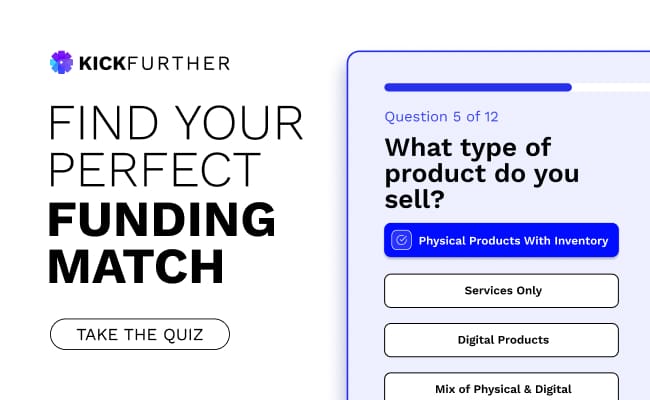

That’s why we created a simple, interactive funding quiz that helps brands like yours discover whether consignment funding, revenue-based financing, or traditional loans make the most sense for your current stage and goals.

The problem we’re solving

After working with hundreds of CPG brands, we’ve noticed a pattern. Many businesses pursue funding options that don’t align with their cash flow needs, balance sheet goals, or growth stage. Some end up with debt they don’t need. Others miss out on flexible options that could fuel faster growth.

The reality is that there’s no one-size-fits-all funding solution. A $5M food brand scaling into Target has very different needs than a $500K startup launching their first product run. A business with strong margins and quick inventory turns might thrive with consignment funding, while a service-heavy business might need alternative solutions.

What the quiz covers

The 2-minute assessment asks 12 targeted multiple-choice questions about your business, including:

- Your location and annual revenue

- Industry and product type

- Margin profile and inventory turnover

- Funding amount and cash flow priorities

- Credit profile and sales channels

- Current growth stage

Based on your responses, you’ll receive a personalized recommendation that explains:

- Which funding model best fits your business (consignment, revenue-based, or traditional)

- Why that option aligns with your specific situation

- Key features and considerations for your funding path

- Next steps to move forward

Take the quiz and find your funding match in 2 minutes!

No pressure. Just honest guidance on the funding path that makes sense for your brand.

Whether you’re ready to scale into new retailers, fund a major production run, or simply explore your options, this quiz will point you in the right direction.