How Purchase Order Financing Can Help an Ecommerce Business

Whether it’s starting up or in the midst of rapid growth, maintaining positive cash flow is the element of survival for both a traditional and ecommerce business. Well-managed finances and positive cash flow allow your company to grow unchecked and withstand the inevitable headwinds while you develop your presence in the marketplace. A high percentage of businesses with excellent early promise, including ecommerce companies, fail because of poor cash management.

Knowing what financial resources and strategies are available to keep your boat afloat while you continue to grow is an essential component of any business development.

Ecommerce: The Great Advantage

In addition to not tying up huge amounts of your capital in bricks, mortar, and display, ecommerce usually offers the seller the benefit of receiving payment before shipment. Typically buyers see the range of products on your website or other Internet location and easily select the items and quantities they want. The buyer is then channeled to a payment portal where they pay for the order with a credit or debit card, or by other means.

Well-financed commercial customers and government agencies may also be customers of ecommerce businesses, and they are always looking for promising merchandise to market or use. In these cases, purchase order financing is a very viable option to consider, and it’s easy to obtain because of the customer’s creditworthiness.

However, the fundamental expectation of an ecommerce business is that you have the inventory to ship within a few days of when the order is placed or the core ecommerce advantage to the customer is lost. Depending upon how your supply chain is structured, i.e. your on-hand inventory and the supplier lead-time, the inventory investment will still precede the funds received from the transactions.

Financing Your Needs: The Order Surge

As any business grows, projecting incoming and outgoing cash becomes more complicated when demand is unpredictable, or unanticipated large bills suddenly strike. If your business is a combination of traditional and ecommerce retail, the product flow becomes more complicated.

What do you do when that seemingly delightful huge surge in demand or a single large order comes in that puts you in a quandary about how to proceed? Let’s say you have received an order of a magnitude that you’ve never experienced before. Once the initial euphoria subsides, you may realize that you do not have the inventory in-house or within your ready supply chain to fulfill the order. Your supplier may not produce and ship without payment in advance or a guarantee from a reputable source. Your cash-on-hand is not nearly sufficient to handle the manufacturing and shipping costs plus all of your normal daily expenses.

Having to reject an order because of a lack of funding can seriously blemish a company’s reputation. If this happens, the opportunity for other large orders may be diminished and your momentum can be permanently stifled.

Your only option is to borrow. But where do you go? You may have used up any normal business line of credit and other borrowing options could have been pretty much depleted, too. All you have is a purchase order for a sizeable volume from a reputable customer that must be shipped in five days. This can be a make-or-break situation for a growing company.

What is Purchase Order Financing?

Purchase order financing can be the financial bridge between the production and shipping for a large single order or multiple orders and the delivery to and payment from the purchaser. The solution may be that the large order you received can be placed with the producer along with a guaranteed payment from a purchase order.

How Does Purchase Order Financing Work?

Purchase order financing is ideal for handling large orders for which you may not have the funds to pay for upfront. The money is advanced to the supplier to produce the finished product.

For ecommerce purchase order financing, a written agreement is created between the seller and those involved in funding, in which those providing funding agree to pay the supplier. Those funding the purchase order advance the capital needed based on the calculated manufacturing and shipping costs. Those funding the purchase order are assured to be paid based on the sale of goods in the purchase order. In conventional or mixed businesses, once the products are delivered to the customer and an invoice is generated, the seller can pay those who funded the purchase order and receive his margin.

Another option is for the purchase order financier to open a line of credit with the manufacturer. The selling company eventually receives the total invoice price minus the fees paid to the funders.

One common misconception is that purchase orders are held as collateral for an equal or lesser amount of money advanced to you. In reality, the purchase order financing company pays money directly to the supplier for the finished goods that will be shipped to your customers. Customer funds go directly to the financing company and the difference between the supplier price and the retail cost minus the financing cost is distributed to the seller. One of the advantages to this process is that the company’s cash flow is not affected by the timing differences between income and outgo. Purchase order financing is used only for finished goods.

Finance Your Next Purchase Order

What is the Difference Between Purchase Order Financing and Factoring?

Two methods of financing transactions, purchase order financing and factoring, are quite different, but with traditional businesses they can be used in tandem to manage specific transactions. While they are used together, they will be applied to different segments of your supply chain. A purchase order financing program assists your company by financing the production or sourcing of inventory for large orders. A factor extends money to bridge the cash flow gap between the payment for goods sold and the receipt of payment.

As mentioned, these two funding sources are sometimes used in tandem to finance a large transaction. The purchase order financier pays for the inventory to be produced and shipped to the end user based upon a purchase order and the customer’s creditworthiness. The factor may then extendthe money to your company to pay the purchase order finance company based upon the accounts receivable.

Scenario

Those who fund purchase orders, love transactions that involve major retailers. For example, consider what would happen if a buyer for a retailer with a national presence should fall in love with a cooking utensil that you regularly market on your website. The buyer may want to test market an initial order that is beyond your financial ability to deliver. This is the type of scenario that those funding purchase orders prefer, since the payment is virtually guaranteed with such a prominent customer.

To put it simply, the process begins when the order is accepted, then the manufacturer/supplier is paid by the funding process, the product is shipped, the retailer remits payment to those who funded the purchase order, and then the seller receives the remaining portion of the gross margin after fees.

Advantages of Purchase Order Financing

Purchase order financing is not as difficult to obtain as some other types of financing if the financial quality of your customer is solid. Usually, the process can be set up quickly once the order has been verified. Small companies have generally used this process to great advantage and have employed these instruments to grow their business substantially. This works best when your company generates solid orders with sufficient pricing, the manufacturer has the adequate capacity to meet the time restrictions for production, and the credit quality of the customer is worthy.

In summary, the advantages of purchase order financing are:

- An Ecommerce company may finance large orders without tying up its capital.

- Customers will not be turned away because of an inability to deliver.

- The receipt of timely payments will guarantee a company maintains an excellent relationship with its suppliers.

- This financing may be combined with factoring to finance receivables in case customer payments are scheduled a considerable time after delivery.

Who is a Candidate for Purchase Order Funding?

Not every seller of goods can qualify for purchase order funding. Companies that qualify, including those in ecommerce, must meet certain specific criteria. These criteria may differ depending upon your company’s track record and stability.

The standard criteria are:

- Must be a reseller of completely finished goods from a single 3rd-party finished goods manufacturer.

- Gross margins must exceed a certain amount, usually greater than 25 percent.

- Monthly sales should amount to at least $10,000.

- Customers must have good credit or pay prior to shipment.

Manufacturing companies may not be candidates for purchase order financing for two reasons. Firstly, because they likely have several suppliers to create a single product so the transaction can be too complex. Secondly, if the finished products are not satisfactory the customer may not buy them, thus leaving the purchase order financier holding the bag.

Resellers with ecommerce sites are excellent candidates for this type of financing.

Applying for Purchase Order Financing

While it is important to establish a relationship with those financing your purchase orders, the transactions take place one at a time. To get the support for a specific transaction, you must have an itemized detailing of each step and cost component. Once the transaction is clearly understood, the most important part is the credit worthiness of the buyer — this is the central element of the value of the transaction.

Once customer creditworthiness is established, the details of the transaction emerge. A chart or spreadsheet is a good accompaniment to the application in order to demonstrate each logistical step and cost component.

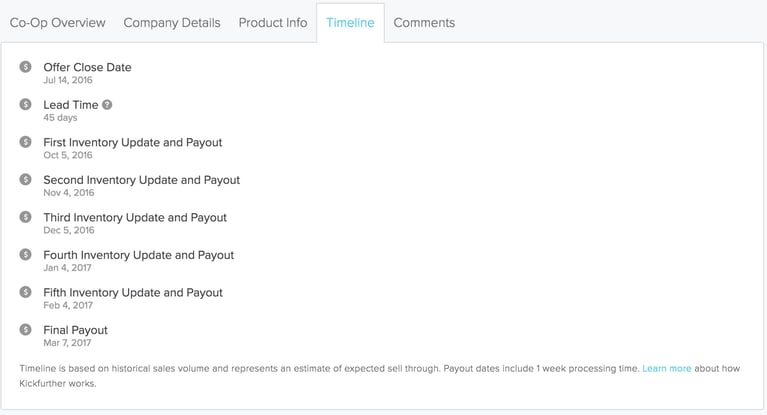

Here’s an example of the timeline breakdown for LE BLOC, one of Kickfurther’s successful Co-Ops.

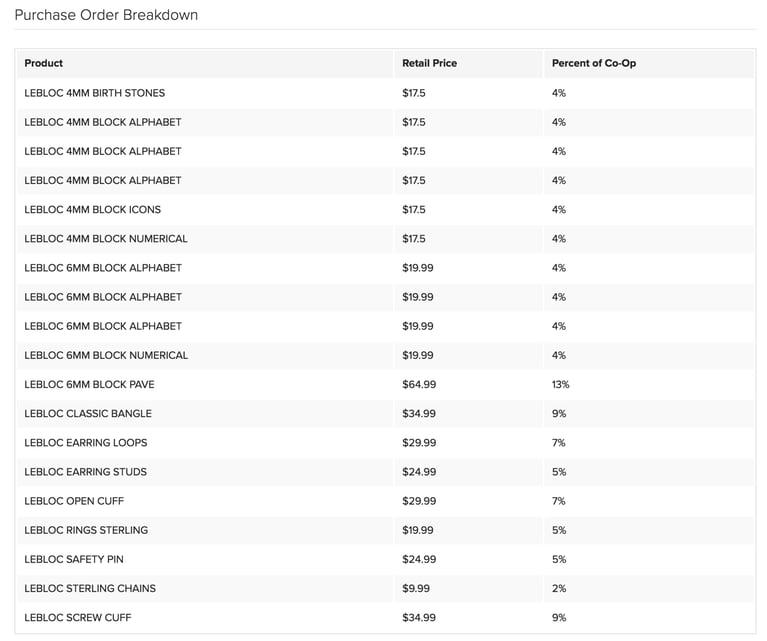

In addition, contributors were provided with the purchase order breakdown to understand where the money was flowing.

Making the Purchase Order Funders a Part of Your Team

As you finance your purchase orders, it’s important to build a relationship of trust with the contributors. As these purchase orders are separate transactions, you may need to tap into that audience of contributors again in the future. After all, if your business is growing the contributors will benefit as well.

Evaluate Your Supply Chain

Before a demand surge hits, you need a precise picture of your own supply chain. Chart all components, including supplier lead time to production, normal supplier on-hand inventory, order fulfillment time, and transit time to determine the maximum lead time required. Capitalize on your close relationship with the supplier and keep track of inventory quantities at all times. Also consider your own on-hand, ready-to-ship inventory, wherever it may exist.

All of this will create a complete picture of how much time is required to replenish stock. Since the key to ecommerce is to have product ready to ship on short notice, developing a system of accurate forecasting becomes critical.

Demand Forecasting

Too little inventory can be overly expensive because of late shipments, unplanned production costs, or emergency deliveries. Too much inventory is also costly in tied-up capital, storage and handling, and, in some cases, shelf-life expiration. Carrying the right amount of product in the right places is essential.

Accurate Forecasting Helps to Ease the Demand on Forecasting

Perfect forecasting is a key to success. Complex mathematic formulae have been created from historic and anticipated demand data to best handle the correct placement of products to meet short-term demand. In a growing multi-million ecommerce business, demand is not always predictable, largely because there is very little relevant historic or projected consumer data.

The first overwhelming order can leave even the most confident forecaster in tears.

Cash Flow Management and Growth

Facilities like purchase order financing and factoring remove a burden from an ecommerce company’s finances. Your special skills are in marketing and selling products. Therefore, your cash needs to be focused on developing the organization to manage and grow with your selling ability. The elimination of the financial burdens and timing of inventory management, large supplier payments, and accounts receivables simplifies your business in many ways. Besides sales and marketing, your ecommerce business should focus on partners and employees who understand your supply chain, can oversee faultless order processing and invoice management, while effectively managing the finances of a growing ecommerce venture.

Purchase order financing not only removes the burden of tying up capital for individual orders, the process also frees up capital for growth. As sales increase and orders are handled efficiently, your reputation will grow and more orders will follow. Additional products may then be added to your inventory and your position in the market solidified.

Without purchase order financing, your company may fail to execute a large order or a surge in orders, and your ability to grow will be seriously stunted. Or you may invest all of your available capital to complete a large order and be unable to meet payroll or other operating demands. This could signal the beginning of the end for your ecommerce company.

It is never too early to plan for growth. Check out all of your funding opportunities as you develop the business. Purchase order funding should be a ready weapon in your arsenal of business assets.

Interested in learning more about inventory financing through Kickfurther? Apply today at Kickfurther.com.