This is a guest post by Money Crashers

Passive income has a bad rap because too many people charge money for courses promising millions in profit every year. The term leaves the same taste in your mouth as “get rich quick” and “multi-level marketing.”

You’re right to be skeptical, but real passive income opportunities happen daily. These aren’t instant and false millionaire promises. They’re ways to work a little harder now to make just enough money to change the financial course of your life.

It starts with a trickle, which you can turn into a stream. And with work and smart decisions, you can leverage that stream into the life you’ve always wanted.

Two Preliminary Truths

Before we get to the seven techniques to leverage passive income, you need to understand two basic facts:

Truth #1: These Techniques Work for Any Form of Passive Income

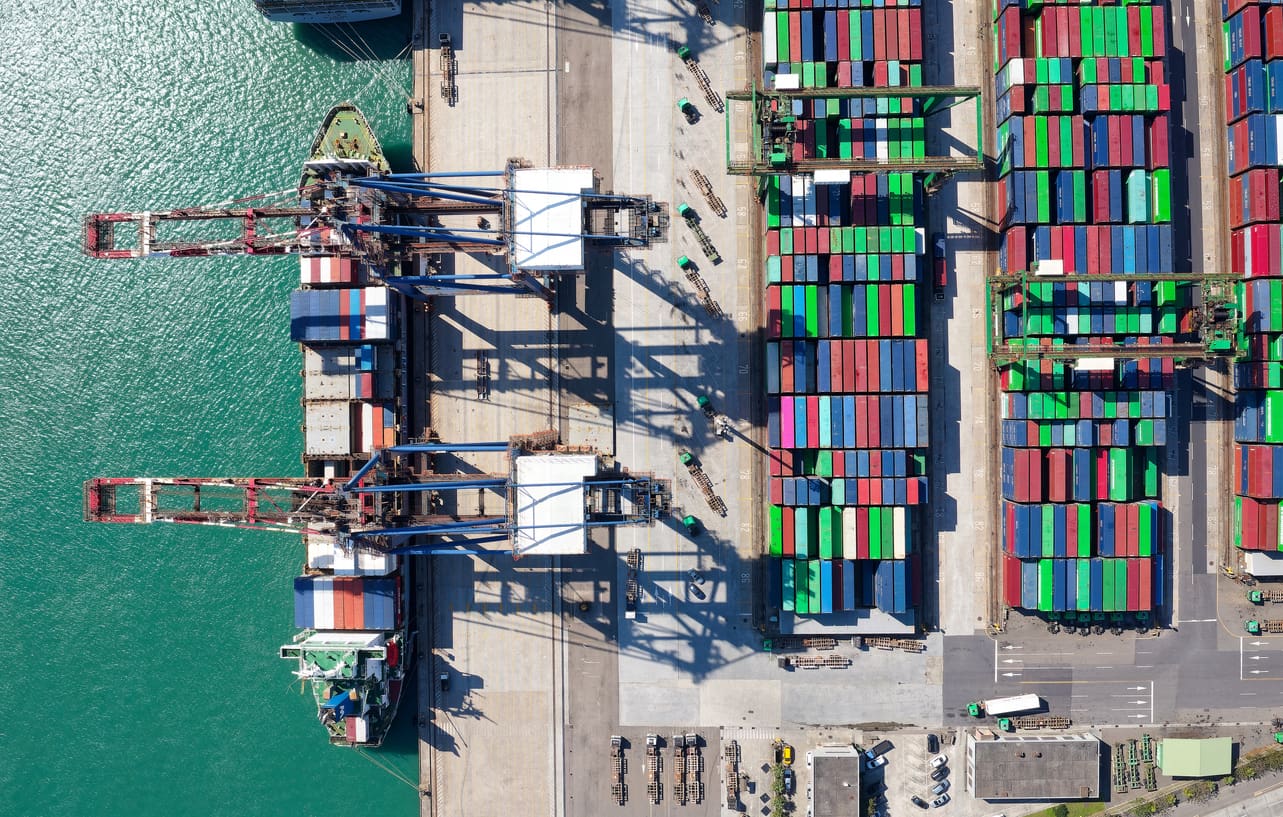

Passive income is earnings created from a type of entity in which you’re not actively involved. Possible options are Amazon small businesses, rental properties, investments, and drop-shipping. No matter what kind of passive income you choose to explore, the ideas below will help you craft ways to harness the income you generate.

Truth #2: Passive Income Doesn’t Start Passive

No one is saying this will be easy. You will invest time in research, setup, marketing, and management in the first months and even years of your passive income empire. Once you get things rolling, though, it will snowball and leave you with ample free time while the money takes care of itself.

With those truths in mind, let’s get to the techniques.

7 Ways to Leverage Passive Income and Change Your Life Forever

1. The Debt Snowball

If you have credit card debt, use your passive income to cut yourself free from it. Apply all of your extra income from your side projects to killing your lowest-balance loan. Once it’s dead, apply all of that plus the minimum payment for that loan to the next-lowest balance. Over time, you’ll be debt-free except for your mortgage – and even that will look like something you can manage in a matter of years.

The less debt you have, the farther your existing income can take you. This fundamental change to your personal balance sheet will change your life.

2. Going Halfsies

Many believe extra money is for luxuries and enjoyment. But that’s why so many people have good short-term finances but a poor long-term prospectus. The smart financial move is to put any extra money you make into investment accounts or use it to pay off loans.

The good news is you can live the life you want right now and shore up your finances at the same time. Just split the difference. With your primary income covering your base expenses, cut your passive income in half. Take half of your passive income and spend it however you want. You can buy a car, a bigger house, go on vacation, or spoil your kids or grandkids. The other half of that extra income goes toward the future, such as paying off debt, saving for retirement, or investing in training programs for your career.

This way, you keep yourself motivated to make passive income, but you’re still focused on your long-term financial health.

3. The VA Revolution

As you build your passive income streams, time rapidly becomes the limiting factor. With the demands of your primary job and family, your passive income may not grow as quickly as it could or should.

Thankfully, a combination of global communication and arbitrage has created an entire industry of competent virtual assistants (VAs) who cost less than $10 an hour. You could easily find five hours per week of tasks they could do for you. You’ll give yourself an extra 20 spare hours for the month for just $200. That’s an excellent way to save time at a low price. And as your side-business grows, you may consider spending another $200 for a total savings of 40 hours a month.

The sheer number of VAs out there can make it hard to find a reliable service, but TaskBullet has compiled a list of eight high-quality providers.

4. Rinse and Repeat

We mentioned earlier how passive income is only passive in its later stages. In the beginning, you work, and you work hard. Once it’s rolling, the money comes in with only the occasional checkup. When you reach that point, you have two options.

The first is to enjoy the money. Even if it’s not enough to quit your day job, it’s likely enough to lower your financial stress and allow you to enjoy a few of the finer things in life. There’s nothing wrong with that.

The other option is to do it again. Once your first enterprise is mostly automatic, take that energy you spent building it to build a second passive income stream, then a third, then a fourth – until your income is where you want it to be. Then you can go ahead and do the first option in real style.

5. Re-Investment

Once your passive income grows and reaches a level of self-sufficiency, you can scale your business and earnings by investing income back into the business. A few ideas include:

- Increasing your advertising budget

- Offering a product on additional channels

- Adding variety to your products

- Expanding into new markets

- Hiring sales staff

- Buying materials in bulk to cut production costs

- Purchasing more shares of stock

- Buying additional rental units

Each passive income system has different opportunities for expansion. Investing your early returns is one of the best ways to take advantage when your side business is poised for expansion.

6. Partial Retirement

The dream of passive income is to earn enough from these low-demand streams that you can quit your job and live off the proceeds. That’s a high hurdle for some people, especially when you consider the value of your benefits package. It can seem so far off it’s hard to get motivated.

But there’s a way to accelerate your dream of leaving your full-time job: Get your income to a point where you can go part-time in your current job, or move to a new job that’s less demanding, more fulfilling, or both. You can pour the extra time and energy you’ll have into your side business. You’ll earn more passive income more quickly and reach full retirement years before you thought it possible.

7. The Points Game

This technique requires some fine-tuning, and it’s not for everyone. But it’s a surprisingly easy route to free money via your passive income. Here’s how it works:

Step One: Put all of your passive income expenses on rewards credit cards, preferably with an eye to which cards give the best rebates for which kinds of purchases.

Step Two: Always pay off everything within the grace period so that you avoid any late fee or interest.

Step Three: Repeat as often as possible.

With the scale of expenses increasing as your passive income business grows, these rewards will build up faster than you think. Free travel and significant cash rebates will be in your future.

A word of caution: Only try this technique if you’re sure you can reliably pay off your expenses in full each month. Otherwise, interest and other charges can nullify any rewards you might earn.

Final Thoughts

Where to begin building passive income

The best part about these seven ideas is you don’t have to choose between them. Once you have passive income rolling in steadily, you can apply a portion of it to all of these practices. Each one will yield steadily increasing benefits until your life is unrecognizable from what it used to be.

But just like getting started with passive income, it all begins with action. Make a decision, do the work, and move forward today.

Ready to earn with Kickfurther? Fund growing brands’ inventory and profit as it sells. Get started with $10 in credit here: kickfurther.com/get10