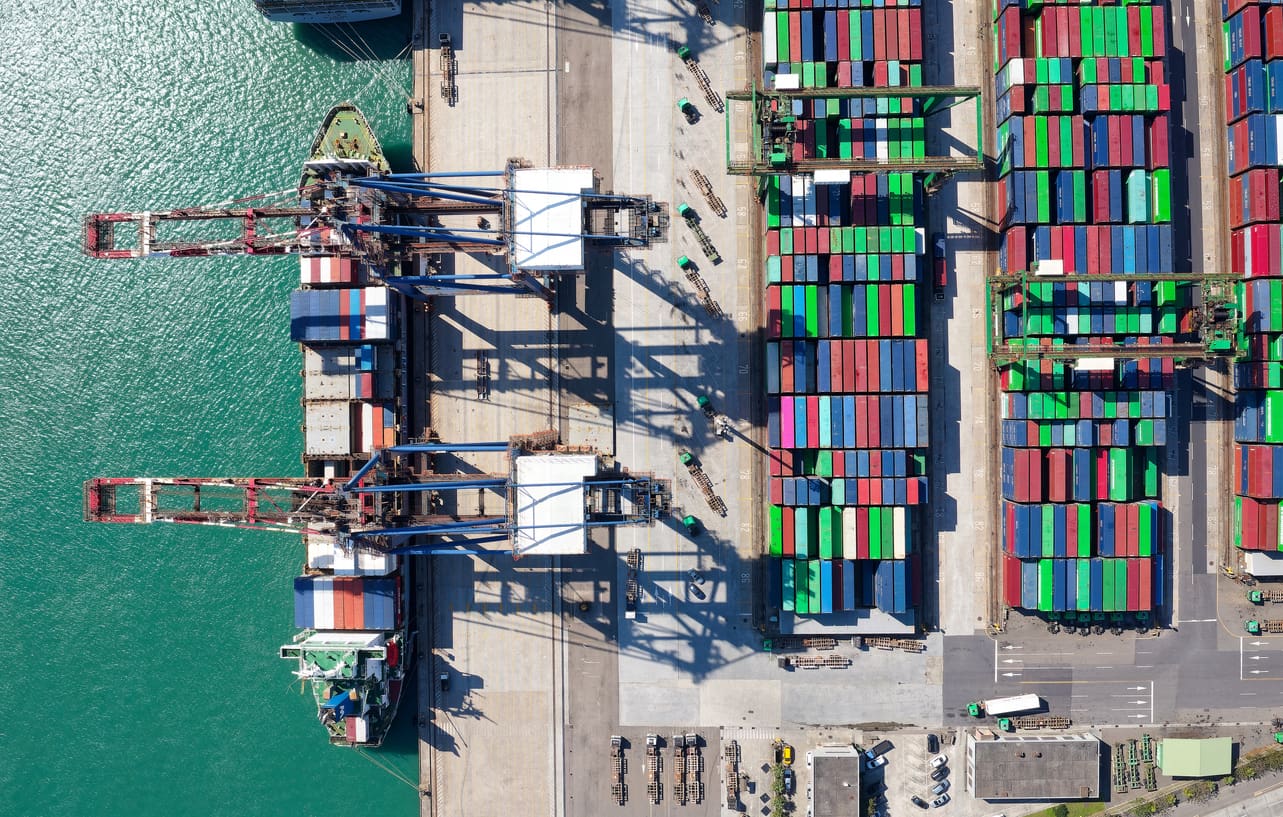

In April 2025, newly announced tariffs went into effect, sending ripples across the consumer packaged goods (CPG) industry. As import costs rise, brands are being forced to re-evaluate everything from pricing strategies to supplier relationships.

At Kickfurther, we surveyed our founders and operators to understand how these changes are impacting their business models currently and what steps they’re taking in response. The results paint a clear picture: while the pressure is widespread, the responses are strategic, varied, and in many cases, proactive.

Affected Across the Board

More than half of respondents (51.3%) indicated that their business has already been affected by the new tariffs. While the full impact may still be unfolding for some, most founders are already feeling the pinch in one way or another.

Where the Pressure Is Hitting Hardest

When asked which aspects of their business were most affected, the leading response was clear:

-63.4% cited pricing and margins as their top concern

-22% pointed to supply chain and sourcing challenges

-12.2% aren’t yet sure where the full impact will land

-2.4% noted pressure on retailer or distributor relationships

This data underscores how tariffs are not just a bottom-line issue, they touch multiple operational layers, from procurement to point-of-sale.

Cost of Goods Sold on the Rise

One of the most immediate effects of the tariffs has been an increase in Cost of Goods Sold (COGS):

-41.5% of brands said their COGS have increased significantly

-39% expect increases in the near future

-Only 7.3% reported no impact at all

These shifts directly affect profit margins, prompting many businesses to make tough calls about where to absorb costs and where to pass them along.

Strategies in Motion

To stay resilient, CPG brands are adopting a range of strategies. When asked what changes they’re making in response to the tariffs, brands said:

65.9% plan to raise retail prices

36.6% will absorb the cost and reduce margins

36.6% are switching suppliers or countries of origin

17.1% are adjusting production timelines

17.1% are increasing inventory ahead of the tariffs

9.8% are making no changes at least for now

9.8% cited other adjustments unique to their business

These numbers reflect both immediate tactics and longer-term strategic shifts. From nearshoring to smarter inventory planning, CPG brands are responding with flexibility and foresight.

Impact Across Categories

Tariffs are impacting brands across a diverse set of product categories. Survey respondents represented:

Apparel & Accessories – 26.8%

Food & Beverage – 19.5%

Beauty & Personal Care – 19.5%

Health & Wellness – 17.1%

Electronics – 7.3%

Home Goods – 7.3%

Other – 2.4%

While the nuances may differ, the message is the same: across categories, CPG businesses are adjusting course.

Final Thoughts

The April 2025 tariffs are creating new challenges for the CPG space, whether it’s rethinking pricing, diversifying suppliers, or investing in inventory ahead of deadlines. At Kickfurther, we’re proud to support CPG brands through dynamic market conditions like these. With our flexible funding model, we’re here to help brands weather volatility and grow further.